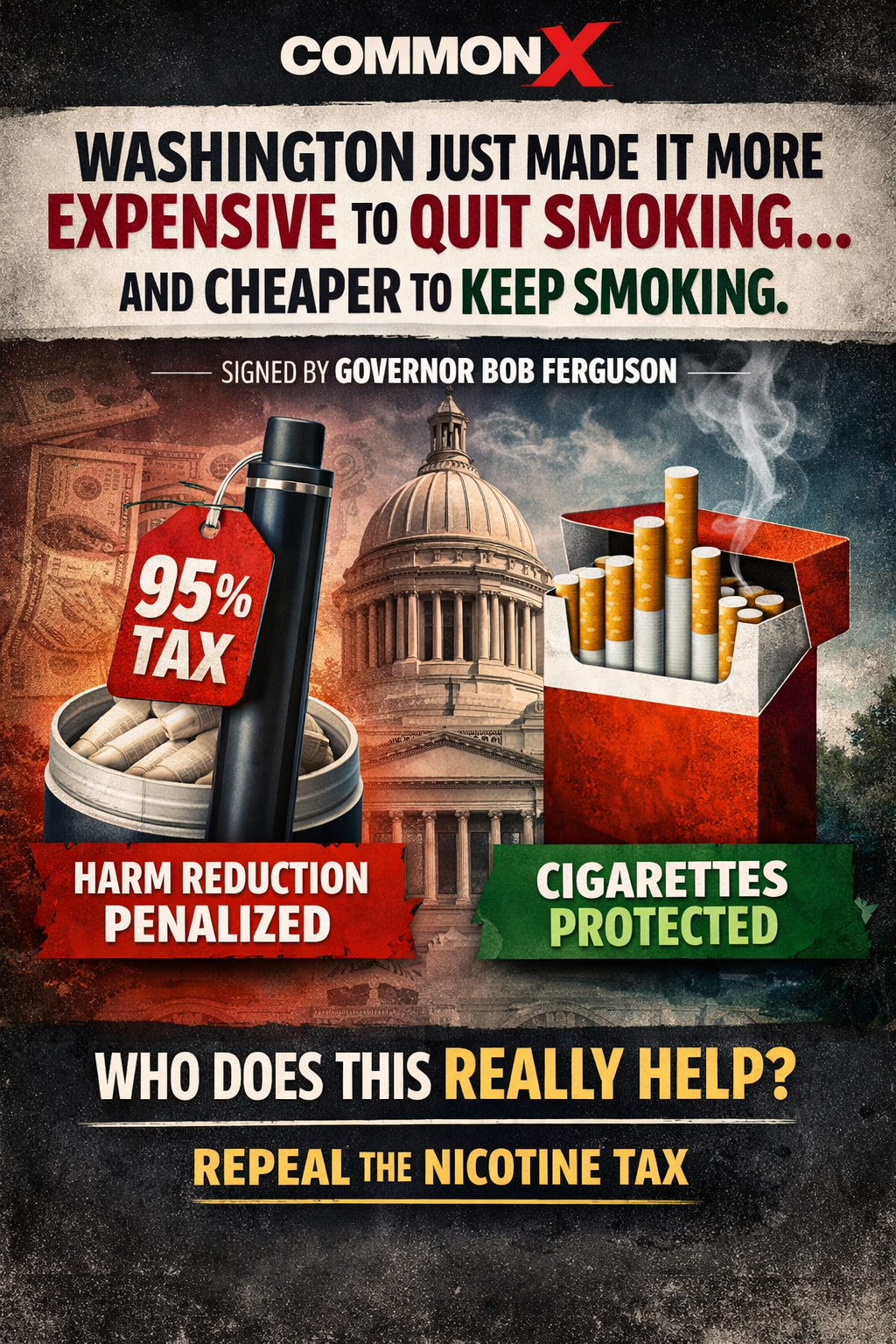

Washington State Just Made It More Expensive to Quit Smoking — and Cheaper to Keep Smoking

How a new state tax signed by Governor Bob Ferguson could push ex-smokers back into cigarettes — and what citizens can do about it.

By Ian Primmer — CommonX Podcast

OLYMPIA, WA — Beginning January 1, 2026, Washington state will impose a 95 % excise tax on nearly all nicotine-containing products — including synthetic nicotine pouches, vaping devices, and other alternative nicotine products — by bringing them under the state’s tobacco products tax. The change was made through Senate Bill 5814, signed into law by Governor Bob Ferguson as part of the 2025 legislative session.

What that means in real terms: a pack of nicotine pouches or a disposable vape that used to cost $7 might now cost more than $15 with the tax added — nearly doubling the cost of products many people depend on to stay away from cigarettes.

A Public-Health Contradiction

When Washington expanded its tobacco tax law to include nicotine products, lawmakers said they were adapting to a changing market — but critics argue the result is a policy that punishes people for quitting cigarettes. Because cigarettes themselves are taxed under a different structure, this new tax can make safer alternatives more expensive, even though federal regulators consider some of those products to be lower-risk than combustible tobacco.

For many former smokers, vaping and nicotine pouches have been key tools to quit the far deadlier habit of smoking. But when the cost of these alternatives soars, the financial incentive to stay smoke-free weakens — and some may find themselves sliding back toward cigarettes, the very thing they worked hard to quit.

Governor Ferguson’s Role

Governor Ferguson had the authority to veto the tax provisions in the budget but instead approved the package that included the nicotine tax increase. His signature means this policy now stands as law and will begin affecting consumers and small businesses early next year.

Critics argue that this decision contradicts broader public-health goals — and that it was driven more by revenue needs than by science-based health policy.

The Unintended Consequences

Public-health research shows that when healthier alternatives to smoking become less affordable than cigarettes, substitution patterns can reverse: people who are trying to quit may keep smoking instead of using taxed alternatives — exactly the opposite of what public health policy should encourage. Some legal challenges have already been filed, arguing that the way the law is being applied to vapes and other products may exceed what the Legislature actually intended.

How We Fix It

This policy isn’t set in stone — and Washington residents have at least three clear paths to change it.

1. Initiate a Ballot Measure to Repeal or Amend the Tax

Washington’s Constitution allows citizens to gather signatures to put a measure on the ballot that would:

Repeal the expanded nicotine tax,

Or adjust it so cigarettes and nicotine-replacement products are taxed equitably,

Or exempt nicotine products used as smoking-cessation tools.

To qualify, an initiative typically needs signatures from about 8 % of the votes cast in the last governor’s election, spread across at least five counties. That’s roughly 325,000 valid signatures in total — a heavy lift, but feasible with coordinated effort.

2. Support or File a Legal Challenge

Already, some petitions argue that the tax is being applied in a way that conflicts with existing statutes or exceeds legislative authority. Those cases could delay enforcement or narrow how the tax is interpreted if courts agree.

3. Elect New Representatives with Better Health-Policy Judgement

Policy change flows from the ballot box as well as the initiative process. Supporting candidates who understand harm reduction and public-health science can shift the legislature’s priorities in future sessions.

Why This Matters

This isn’t just a tax story — it’s a public-health story about people who worked for years to quit smoking and now face a policy that could push them back into the very habit that harms them most. It’s a story about accountability and policy that actually helps people make healthier choices. And voters, not Olympia alone, should decide whether Washington’s government has gotten it right.

Governor Ferguson thinks he can’t be stopped, yes WE can stop him!